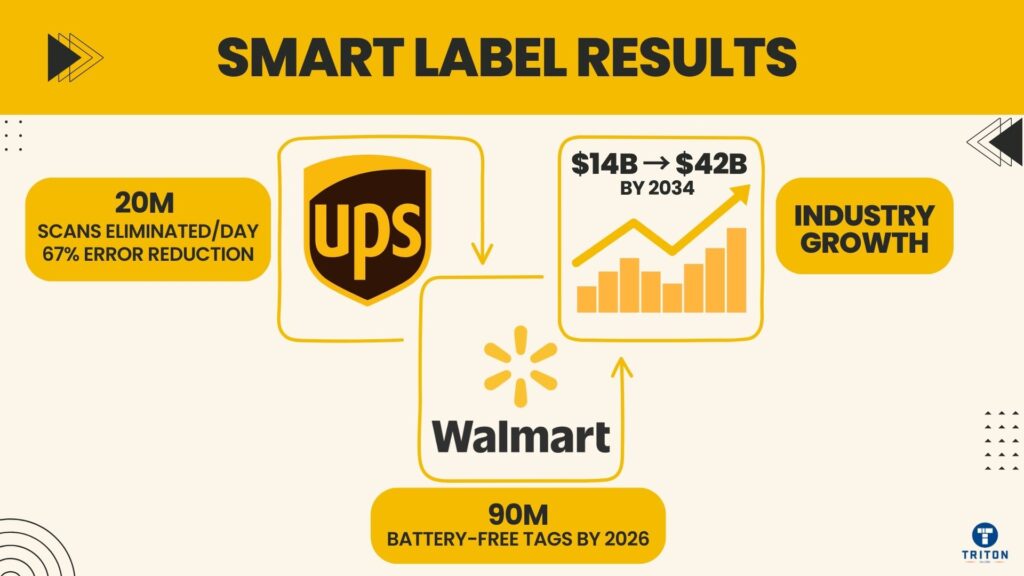

Walmart plans to deploy 90 million battery-free Bluetooth IoT tags across 500 stores by the end of 2025, with a total of 90 million tags across 4,600 locations by the end of 2026. UPS eliminated 20 million manual barcode scans per day and reduced misrouting errors by 67% using RFID infrastructure across 1,000 distribution centres.

The smart label market is expected to grow from $14-15 billion in 2024 to $42 billion by 2034, reflecting an 11% compound annual growth rate.

These numbers represent more than market expansion. They mark the end of a decade-long wait for smart label technology to move from experimental pilots to production scale.

Around 2020, RFID technology dominated the smart labelling market and IoT-enabled labels existed mainly in pilot stages with limited large-scale production.

Between 2022 and 2025, multiple technologies matured simultaneously, creating an inflection point. Smart labels transitioned from “interesting pilot” to “production deployment.”

The difference between a pilot project and production reality lies in scale and economics. Pilots work in controlled environments with subsidised costs.

Production deployments require billion-label volumes, sub-dollar pricing, and infrastructure that works without specialised expertise. That transformation happened between 2022 and 2025.

Five specific technical advances solved the barriers that kept smart labels in research labs and pilot programmes for over a decade. These breakthroughs converged between 2022 and 2025, creating production viability.

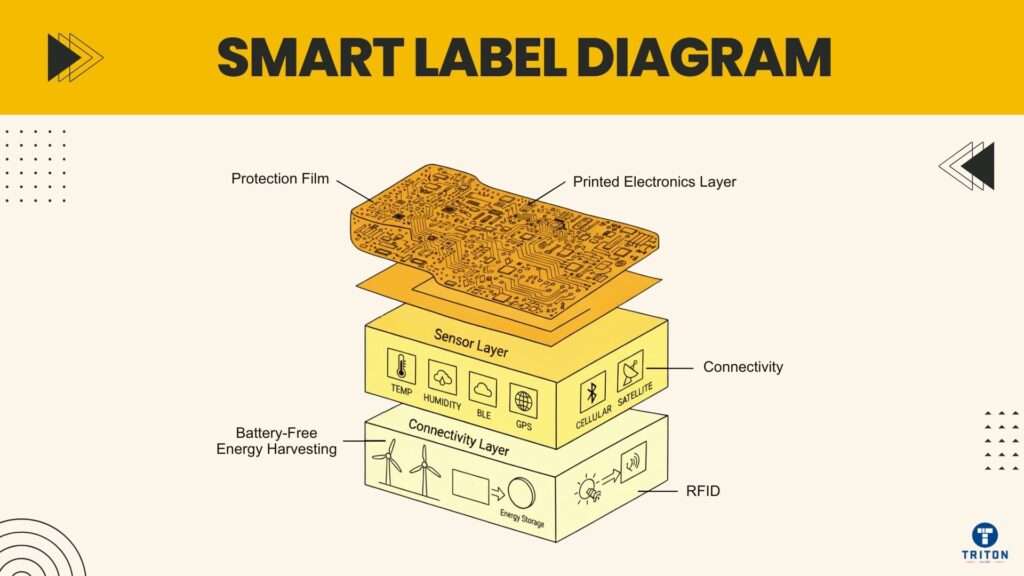

Battery-free operation through energy harvesting eliminated the cost and environmental barriers that prevented billions of disposable labels from becoming viable. Traditional IoT devices often require batteries, which add to the cost, limit their lifespan, and create disposal problems.

Wiliot developed battery-free Bluetooth technology that harvests power from ambient RF energy and solar cells. These “ambient IoT” labels operate “indefinitely” without power sources. Walmart’s deployment of 90 million battery-free labels demonstrates that this technology has moved from concept to production scale.

Printed electronics transitioned from research labs to commercial production in 2023.

Manufacturers can now print flexible smart components directly onto label substrates using conductive inks and specialised printing processes. This manufacturing approach reduces production costs and enables mass production volumes that traditional silicon chip fabrication cannot match. The technology spent years in R&D phases through 2022 before reaching large-scale commercial production capability.

LPWAN connectivity offers infrastructure-free tracking, eliminating the need for specialised readers in every location. Technologies like LoRaWAN, NB-IoT, and LTE-M enable labels to communicate over long ranges using existing network infrastructure.

Roambee’s 5G GPS smart label measures 4×6 inches in a peel-and-ship format, providing “barcode-like ease of use” with continuous IoT visibility. No specialised scanning equipment required.

Multi-network integration enables labels to switch between RFID, Bluetooth, cellular, and satellite connectivity, selecting the optimal channel for each situation.

Linxens produces multi-network labels that support Sigfox, Wirepas, and satellite connectivity. Labels automatically select the most appropriate network protocol based on location, required range, and power constraints. This flexibility eliminates the need to choose a single technology platform before deployment.

Chipless RFID technology uses conductive ink patterns instead of integrated circuits. These “RF barcodes” can achieve costs of fractions of a cent per tag, approaching the economics of traditional barcodes.

The technology maintains digital capabilities that standard barcodes cannot provide, whilst eliminating the electronic components that drive up costs. BLE cold chain labels currently cost $1-2 per label. Chipless RFID targets price points that enable mass deployment across low-value items.

Each breakthrough solved a specific barrier. Battery-free operation solved the power and disposal issues.

Printed electronics solved the manufacturing scale. LPWAN solved infrastructure requirements. Multi-network integration solved technology lock-in. Chipless RFID solved the cost at scale. Between 2022 and 2025, these solutions matured from promising concepts to production-ready technology.

Smart labels in the early 2020s primarily provided identity and location through RFID technology.

Reading ranges were in metres. Labels responded when scanned but took no independent action. The functionality resembled digital versions of barcodes with wireless reading capability.

Modern labels integrate multiple sensor types that monitor and report conditions throughout a product’s lifecycle.

Temperature sensors monitor the integrity of the cold chain for pharmaceuticals and food products, ensuring the preservation of their quality and integrity.

Humidity sensors detect moisture exposure.

Pressure sensors monitor altitude changes and compression forces.

GPS receivers provide location tracking with sub-10 metre accuracy.

Motion, shock, and vibration sensors detect handling problems.

Tilt and orientation sensors identify improper positioning.

Tamper detection monitors whether containers have been opened or tampered with. Light exposure sensors track time outside proper storage conditions.

Connectivity options have expanded from short-range RFID to cellular networks, enabling continuous tracking without specialised infrastructure. Roambee’s 5G GPS label uses cellular connectivity to provide real-time location updates without requiring scanning equipment or specialised readers.

G+D and Sensos developed cellular IoT labels with LTE-M and NB-IoT connectivity combined with GPS and multiple sensors. Identiv and InPlay produce BLE cold chain monitoring labels for pharmaceutical applications that continuously monitor temperature throughout distribution.

Labels transitioned from reactive data collection to proactive alerting.

Early RFID labels stored data that could be read when scanned.

Modern labels analyse conditions in real time and notify systems when thresholds are exceeded. 3M developed next-generation time-temperature indicator labels that actively monitor cumulative exposure and alert when products exceed safe parameters. This transformation moved labels from passive identification devices to autonomous monitoring systems.

The capability evolution changed the fundamental question labels answer. Early 2020s technology answered “Where is it?”

Modern labels answer the following questions:

“Where is it, what temperature is it experiencing, has anyone tampered with it, and does it remain within acceptable parameters?”

That progression defines the shift from identification to intelligence.

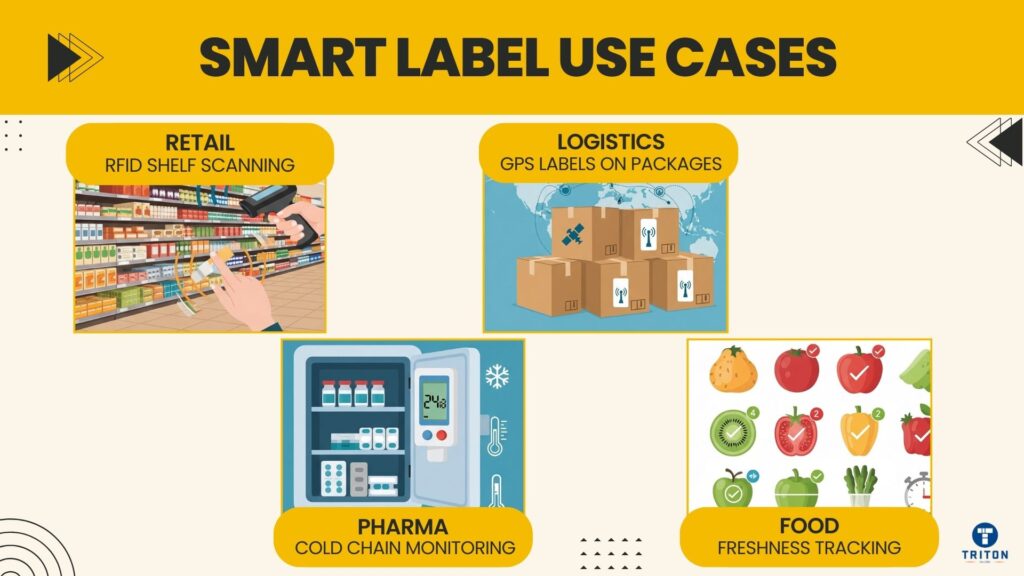

Retail operations achieved misload rates as low as 1 in 1,000 packages by deploying RFID technology at a production scale.

Walmart issued a 2024 RFID mandate requiring suppliers to tag products, which drove compliance across the industry. The retailer plans to deploy 90 million battery-free Bluetooth IoT tags across more than 500 stores by 2026. This deployment transitioned from identification to autonomous sensing, eliminating the need for manual scanning while providing continuous visibility into inventory status.

Supply chain and logistics operations transitioned from manual barcode scanning to autonomous sensing infrastructure. UPS implemented its “Smart Package, Smart Facility” initiative across 1,000 distribution centres and 60,000 delivery trucks. The deployment included plans to equip an additional 40,000 trucks in 2025.

The company eliminated 20 million manual barcode scans per day, reduced misrouting errors by 67%, and achieved a 99% inventory accuracy rate. These metrics demonstrate measurable ROI that justifies the infrastructure investment.

The UPS deployment shows how smart labels change operations beyond simple automation. Eliminating 20 million daily scans removes bottlenecks in sorting and loading processes.

The 67% reduction in misrouting errors results in fewer delivery delays and lower fuel costs and real-time visibility informs dynamic routing decisions.

Healthcare and pharmaceutical applications focused on maintaining cold chain integrity and preventing counterfeiting.

BLE cold chain labels cost $1-2 per label, which pharmaceutical companies accept for high-value products, such as biologics and temperature-sensitive medicines. Identiv and InPlay developed BLE labels specifically for pharmaceutical cold chain monitoring.

These applications address regulatory requirements for temperature tracking whilst protecting product efficacy. Regulatory compliance drives adoption because pharmaceutical companies face penalties for temperature excursions that compromise product safety and quality.

Food and agriculture operations monitor conditions throughout supply chains. Temperature-sensitive products require continuous monitoring rather than spot checks at handoff points.

The deployment scale validates the inflection point thesis.

Walmart’s infrastructure represents production reality. The quantified results, i.e. 67% error reduction, 99% accuracy, and 20 million eliminated scans, demonstrate ROI based on actual operational data.

The implementation across retail, logistics, pharmaceutical, and food sectors indicates that the technology applies to various use cases and operational requirements.

BLE smart labels for cold chain applications cost ~ $2 per label.

Pharmaceutical and biotech companies accept this cost for high-value products where temperature excursions cause spoilage.

A single compromised vaccine shipment exceeds the cost of monitoring every unit in that batch. The economics work when the label cost represents a small fraction of the product value and potential loss.

Chipless RFID technology targets costs of fractions of a cent per tag.

This pricing approach to traditional barcode economics, whilst adding digital capabilities that barcodes cannot provide. At sub-cent pricing, labels become viable for low-value items where current smart label costs cannot be justified. The market volume for smart labels opens when pricing reaches levels comparable to those of barcodes.

Battery-free designs eliminated ongoing power costs and environmental disposal concerns. Billions of disposable labels with batteries create environmental waste and disposal liability. Battery-free operation removes these barriers. The technology also eliminates the limited lifespan that batteries impose.

Labels can serve the entire lifecycle of products, rather than failing when batteries are depleted.

Volume deployments by major retailers drove manufacturing scale that reduced per-unit costs across the industry.

Walmart’s 90 million label deployment created demand that justifies investments in the production line.

Market projections indicate that 581 million smart labels will ship in 2028. This volume enables manufacturers to optimise production processes and negotiate volume pricing for components. The cost reductions that volume enables then make smart labels viable for additional use cases, which drives further growth in volume.

The pricing trajectory transformed smart labels from “only for high-value items” to “approaching barcode economics for mass deployment.”

Chipless RFID, which operates at fractions of a cent, is ideal for consumer goods.

Battery-free operation through energy harvesting eliminated disposal concerns for billions of single-use labels. Battery-powered labels cannot scale to billions of units without creating environmental waste. Batteries contain hazardous materials that require proper disposal and recycling.

Battery-free designs remove this obstacle.

Bio-sourced materials and recyclable components addressed regulatory pressure and corporate sustainability commitments.

Linxens developed multi-network labels using bio-sourced materials that reduce dependence on petroleum-based plastics. These materials maintain the performance characteristics that labels require whilst meeting sustainability requirements.

Companies are under pressure from regulators and consumers to reduce their environmental impact. Labels that support sustainability goals rather than conflicting with them enable deployment at scale.

Printed electronics have a reduced environmental impact compared to traditional silicon chip production processes. Silicon chip fabrication requires high temperatures, specialised chemicals, and cleanroom facilities.

Printed electronics utilise additive manufacturing, which deposits conductive materials only where needed. The process operates at lower temperatures and generates less waste. The environmental benefits accompany the cost and flexibility advantages that make printed electronics attractive for label applications.

Regulatory frameworks, such as the “EU Digital Product Passports”, created mandatory use cases requiring sustainable labelling solutions.

The Digital Product Passport initiative requires tracking product lifecycle data, like materials, manufacturing, and end-of-life disposal.

This regulation creates a mandatory demand for smart labels whilst simultaneously requiring that labels themselves meet sustainability criteria. The regulation accelerates adoption by making smart labels necessary rather than optional, provided the labels meet environmental requirements.

Environmental requirements pushed innovation toward battery-free designs and bio-sourced materials. These solutions simultaneously solved cost and disposal problems. Battery-free operation costs less and eliminates disposal liability.

Bio-sourced materials satisfy sustainability requirements whilst maintaining performance. Regulatory pressure accelerated rather than hindered technology adoption by forcing solutions to address environmental concerns from the beginning. Sustainability functioned as a catalyst rather than a constraint.

The smart label industry is expected to grow from $14-15 billion in 2024 to a projected $42 billion by 2034. Alternative projections estimate $23.7 billion in 2025, growing to $60 billion by 2035.

The specific numbers vary, but the growth trajectory consistently shows substantial expansion driven by increasing deployment scale. Market projections indicate 581 million smart labels will ship in 2028.

North America currently leads market share. Major retail mandates, such as Walmart’s 2024 RFID requirement, drive supplier compliance across the retail sector.

Logistics infrastructure investments by companies like UPS create deployment scale that establishes market leadership. The concentration of major retailers and logistics companies in North America positions the region to drive early adoption and set standards that other markets follow.

Asia-Pacific shows the fastest growth rate. Manufacturing hubs implement track-and-trace capabilities throughout production and export supply chains.

Manufacturers use smart labels to provide visibility from the factory floor through distribution to end customers. Export requirements are increasingly demanding product traceability, which drives the adoption of smart labels. The combination of manufacturing concentration and export requirements positions the Asia-Pacific for rapid growth.

Australia’s IoT market is projected to grow at a rate of approximately 10% annually, reaching $23 billion by 2029.

Australia’s geographic challenges viz. long distances between population centres, create use cases where remote monitoring and tracking provide value. The market growth reflects both general IoT adoption and specific applications where smart labels solve regional requirements.

The market trajectory shows growth across regions.

North America leads through retail mandates and logistics investments. Asia-Pacific grows through manufacturing and export requirements. Australia grows through geographic challenges that smart labels help address.

The regional variations demonstrate the viability of technology across different use cases, rather than dependence on a single application or market segment.

Digital twin integration connects physical products to AI-driven analytics and real-time virtual models of entire supply chains. Current deployments focus on tracking and monitoring.

Digital twins enable predictive management by creating virtual representations that model product behaviour under different conditions.

Companies can simulate supply chain scenarios and optimise operations based on predictions rather than reacting to problems after they occur.

Smart labels provide the sensor data that digital twins require to maintain accuracy.

Blockchain provenance tracking provides immutable records of the product journey. Pharmaceuticals and luxury goods face counterfeiting problems that cost companies billions in revenue, whilst creating safety risks. Blockchain records combined with smart label data create product histories that cannot be altered.

Each handoff and condition change is recorded in distributed ledgers, which provide proof of authenticity and proper handling. Regulatory requirements for drug traceability are driving pharmaceutical companies toward blockchain solutions, which smart labels enable.

Consumer engagement through NFC and QR labels delivers product stories, authentication, and loyalty programmes directly to smartphones. Consumers tap phones against products to access information about origin, manufacturing, and authenticity.

Brands utilise this capability to share product stories and foster customer relationships. Loyalty programmes reward purchases and engagement without requiring separate cards or apps. Consumer-facing applications extend the benefits of smart labels beyond supply chain operations to marketing and customer retention.

5G connectivity enables real-time, high-bandwidth communication for video monitoring, advanced sensor data, and instant response capabilities. Current LPWAN networks provide adequate bandwidth for basic sensor data.

5G supports applications that require higher data rates and lower latency. Video monitoring of shipments, detailed vibration analysis, and immediate alerts for threshold violations become possible. Roambee’s 5G GPS label represents early deployment of cellular connectivity that next-generation networks will enhance.

Multi-network labels support protocols, including satellite connectivity for remote coverage. Linxens produces labels that switch between terrestrial and satellite networks based on location.

This capability extends smart label applications to areas without cellular coverage, including ocean shipping and remote operations. Satellite connectivity fills gaps in terrestrial networks and provides backup when primary networks fail.

Current deployments by Walmart and UPS focus on tracking and monitoring.

Emerging capabilities include predictive management through digital twins, authentication via blockchain, customer engagement via NFC, and expanded coverage through 5G and satellite connectivity.

The trajectory shows smart labels moving from operational tools to strategic infrastructure that enable capabilities beyond those of print labels.

Readers should monitor vendor announcements, regulatory developments such as EU Digital Product Passports, and major retailer mandates as indicators of continued momentum.

Technology adoption follows patterns where early deployments establish viability, which drives investment in production capacity, which in turn reduces costs, enabling broader deployment. That cycle accelerates when infrastructure reaches critical mass.

Smart labels reached that point between 2022 and 2025. The deployments currently underway will drive the infrastructure that enables the applications emerging next.

Get the labelling hardware and supplies you need to support modern IoT and RFID workflows. Visit Triton Store.